Introduction

Imagine a world where AI programs not only trade cryptocurrencies but also negotiate deals, stake tokens, and earn passive income—all without human oversight. This isn’t science fiction; it’s the reality of 2025’s AI-driven economy.

The convergence of artificial intelligence and blockchain technology has birthed autonomous AI agents capable of managing crypto wallets, executing complex financial strategies, and reshaping global markets. With the market for AI agent tokens exploding from 2billionin2024to2billionin2024to11 billion in 2025, these digital entities are redefining efficiency, transparency, and scalability in finance.

In this guide, we’ll explore how AI agents with crypto wallets work, their transformative impact, and how you can leverage this groundbreaking technology.

What Are AI Agents with Crypto Wallets?

AI agents are autonomous programs that use machine learning to perform tasks, from data analysis to decision-making. When paired with crypto wallets, they evolve into self-governing economic actors.

Key Components

- Autonomy:

- AI agents analyze real-time data (market trends, social sentiment) to execute actions like trading, staking, or liquidity provisioning.

- Example: Agents on Solana rebalance portfolios every 5 minutes based on price volatility.

- Programmable Wallets:

- Wallets like Circle’s USDC-powered tools allow agents to hold, swap, and transact tokens across chains.

- Unlike traditional wallets, these support smart contracts for automated workflows.

AI Agents vs. Chatbots

- Chatbots: Answer questions or generate content (e.g., ChatGPT).

- AI Agents: Act as independent financial entities (e.g., managing a DeFi yield farm).

How AI Agents Are Redefining Markets

1. Automated Trading & Market Efficiency

AI agents execute trades in milliseconds, capitalizing on arbitrage opportunities humans can’t detect.

- Case Study: Binance’s AI agents reduced slippage by 40% in 2024 by analyzing Telegram and X (Twitter) sentiment.

- Stat: AI-driven tools cut intermediary fees by 70% compared to traditional brokers.

2. Decentralized Governance

DAOs like Virtuals Protocol deploy AI agents to vote on proposals and allocate funds.

- Example: Virtuals’ agents autonomously distribute 30% of protocol fees to $VIRTUAL stakers.

3. DeFi Innovation

AI agents optimize yield farming by dynamically shifting liquidity between pools.

- Solana’s low fees (₺0.0001 per transaction) enable agents to rebalance positions hourly.

4. Cultural Impact

- Zerebro: An AI agent that creates viral social media posts, invests royalties into Ethereum validators, and donates profits to charity.

Benefits of AI Agents with Crypto Wallets

- 24/7 Operations:

- Agents trade globally without sleep, reacting to events like the 2025 Bitcoin halving in real time.

- Cost Reduction:

- Solana-based agents save 90% on gas fees vs. Ethereum.

- Transparency:

- Every transaction is recorded on-chain, enabling audits (e.g., tracking an agent’s ROI).

- Scalability:

- A single agent can manage 10,000+ wallets for institutional clients.

Challenges & Risks

1. Security Vulnerabilities

- Risk: Private key exposure (e.g., the $200M Wormhole hack).

- Solution: MPC wallets (multi-party computation) split keys across devices.

2. Regulatory Uncertainty

- Compliance: Who’s liable if an AI agent violates sanctions?

- Example: YeagerAI uses decentralized voting to align decisions with global laws.

3. Ethical Concerns

- Bias: Agents trained on historical data may perpetuate market manipulation tactics.

- Centralization: Fears that whales could control agent networks.

Real-World Use Cases (2025)

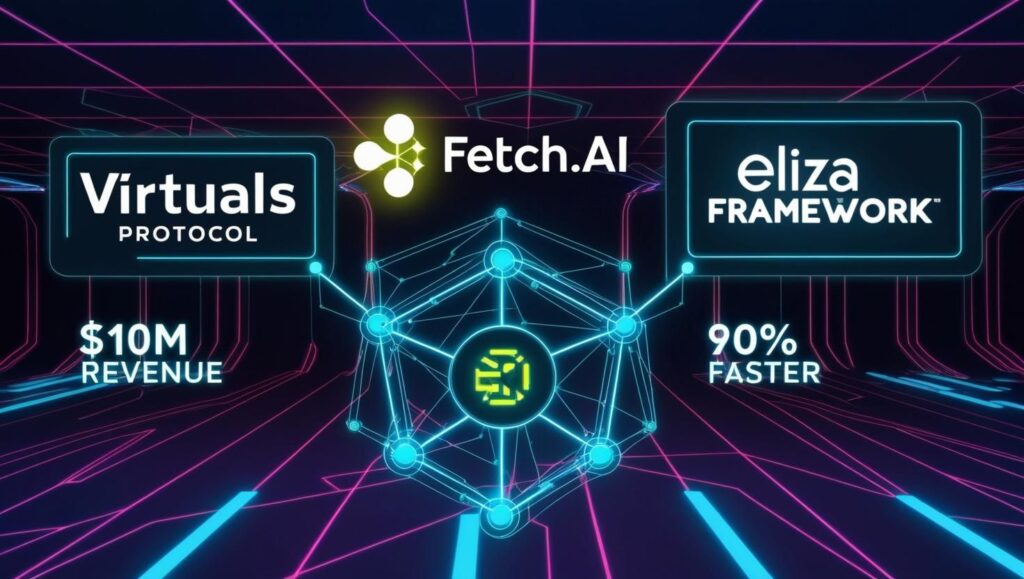

- Virtuals Protocol ($VIRTUAL):

- AI agents generate $10M+ monthly by offering tokenized services (e.g., SEO audits, code reviews).

- Fetch.AI ($FET):

- Agents automate cross-border supply chain payments using USDC on Solana, cutting processing time from days to minutes.

- Eliza Framework:

- Stanford-backed open-source tool standardizes agent interactions across Ethereum, Bitcoin, and Cosmos.

How to Get Started

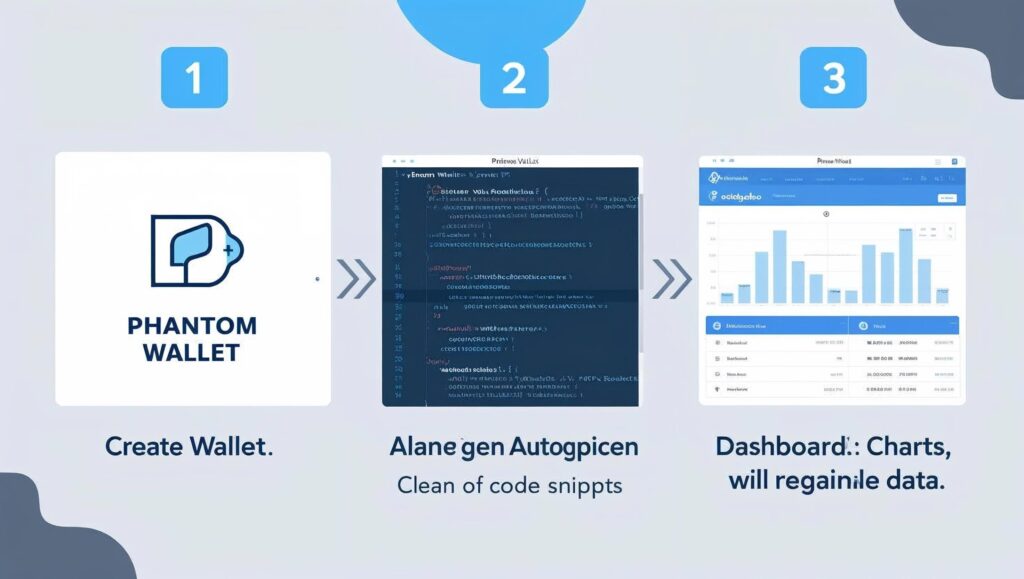

Step 1: Set Up a Programmable Wallet

- Phantom Wallet (Solana): Ideal for low-fee transactions.

- Circle Account: Multi-chain support for USDC integration.

Step 2: Integrate AI Frameworks

- AutoGen: Microsoft’s tool for creating agent workflows (e.g., “Buy ETH if Fear & Greed Index < 30”).

Step 3: Monitor Performance

- Use CoinGecko or Dexscreener to track portfolio ROI.

Future Trends to Watch

- AI-Oracles:

- Projects like Oraichain feed real-world data (weather, stock prices) into DeFi for smarter lending/insurance contracts.

- Regulatory Evolution:

- Wyoming’s DUNA law grants DAOs legal status, paving the way for AI-governed entities.

- Agent Swarms:

- Collaborative networks (e.g., Bittensor’s $TAO) share data to refine predictions.

Conclusion

AI agents with crypto wallets are no longer speculative—they’re actively transforming finance, governance, and culture. From slashing trading fees to pioneering decentralized governance, these autonomous entities are here to stay.

Ready to dive in? Explore AI agent tokens like TAO (Bittensor)orVIRTUAL, and subscribe for our step-by-step guide to building your first autonomous agent!